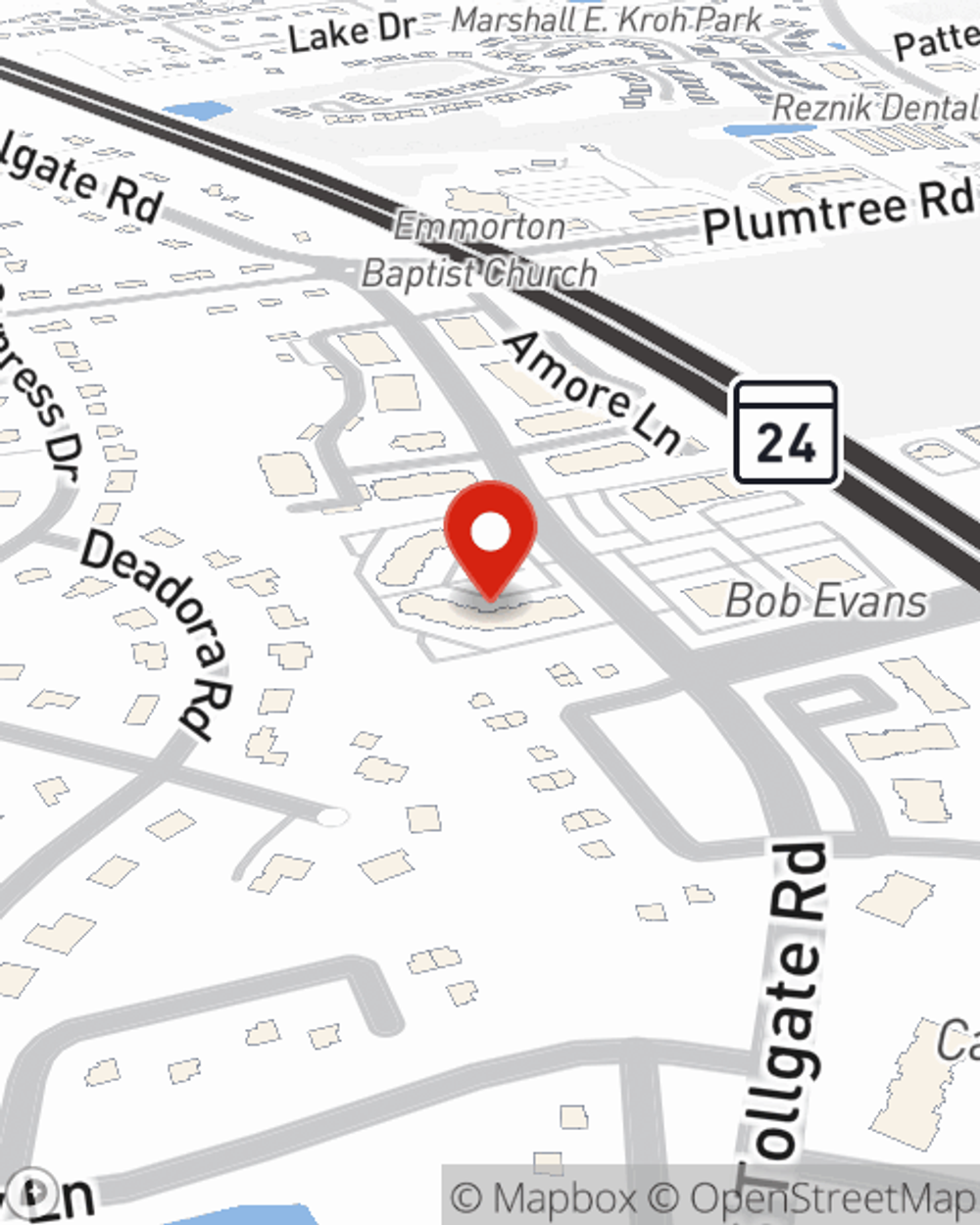

Business Insurance in and around Bel Air

Get your Bel Air business covered, right here!

Insure your business, intentionally

Cost Effective Insurance For Your Business.

Running a small business comes with a unique set of wins and losses. You shouldn't have to wrestle with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including errors and omissions liability, a surety or fidelity bond and extra liability coverage, among others.

Get your Bel Air business covered, right here!

Insure your business, intentionally

Customizable Coverage For Your Business

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Lourice Karkar for a policy that safeguards your business. Your coverage can include everything from a surety or fidelity bond or worker's compensation for your employees to key employee insurance or professional liability insurance.

Contact agent Lourice Karkar to review your small business coverage options today.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Lourice Karkar

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.